The Evolving Landscape of Crypto Regulation

The crypto market is evolving in 2024, largely due to Bitcoin ETF approvals and changing regulations. After years of waiting, the U.S. SEC approved multiple spot Bitcoin ETFs in January 2024; it’s a significant step for institutional crypto adoption, but has also escalated debates on protection for investors, stability of the market, and the future path for decentralized finance.

As governments and financial regulators across the globe struggle to find their way in regulating digital assets, major questions remain: Will Bitcoin ETFs lead to the wider acceptance of cryptocurrencies? What kind of balancing act will it be for the regulators between innovation and risk management? And how will all this impact retail and institutional investors?

An Epic Bitcoin ETF Launch by the SEC

In early 2024, when the SEC approved 11 spot Bitcoin ETFs, doors were flung open for mainstream investors to gain exposure to Bitcoin without having to hold the asset directly. BlackRock, Fidelity, and Grayscale, among others, launched their ETFs, which attracted billions of inflows within weeks. This is seen as the legitimation of Bitcoin as an investable asset class alongside Gold or Equities.

But the nod came with a lot of debate. SEC head Gary Gensler said the choice wasn’t a thumbs-up for Bitcoin itself, mentioning worries about trickery, tampering, and wild swings in crypto trading. The SEC’s careful stance hints that upcoming crypto-related money items will face tough scrutiny, especially those linked to altcoins.

Global Regulatory Developments in Crypto

While the U.S. has taken a measured approach to crypto regulation, other jurisdictions are moving faster—or slower—in shaping their policies.

The European Union’s MiCA Framework

The Markets in Crypto-Assets (Mica) regulation, implemented fully in 2024, establishes a comprehensive regulatory framework for crypto assets within the EU. Mica provides for licensing requirements on crypto firms with much stricter rules on transparency, plus provisions for the protection of consumers to minimize risks involving them in such activities as money laundering and market abuse. It may set a global benchmark for crypto regulation for others to adopt similar standards.

Asia’s Mixed Approach

Countries like Japan and Singapore have embraced crypto with clear regulatory guidelines, fostering innovation while enforcing anti-money laundering (AML) measures. Meanwhile, China maintains its ban on crypto trading, and India is tightening tax policies, creating uncertainty for investors.

The U.S. Regulatory Divide

Beyond the SEC, other U.S. agencies—including the CFTC (Commodity Futures Trading Commission) and the Treasury Department—are vying for oversight of digital assets. This lack of regulatory clarity has led to legal battles, such as the SEC’s ongoing lawsuits against Coinbase and Binance, accusing them of operating unregistered securities exchanges.

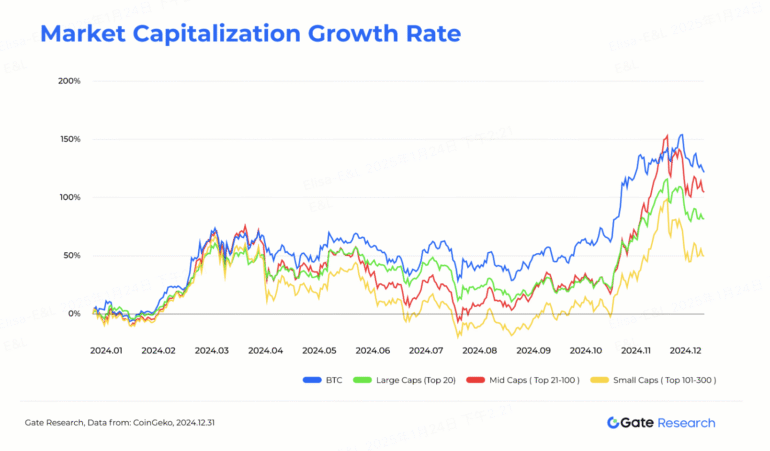

Market Predictions for Bitcoin and Crypto in 2024

The approval of Bitcoin ETFs has already had a profound impact on the market, but experts are divided on what comes next.

Bullish Outlook: Institutional Adoption and Price Surges

Many analysts believe that Bitcoin could reach new all-time highs in 2024, driven by:

- Increased institutional investment via ETFs.

- The Bitcoin halving event in April 2024, which historically triggers price rallies due to reduced supply.

- Growing macroeconomic uncertainty, pushing investors toward alternative assets.

Some predictions suggest Bitcoin could surpass $100,000 by late 2024, particularly if ETF inflows remain strong.

Bearish Risks: Regulation and Market Volatility

However, skeptics warn of potential downsides, including:

- Regulatory crackdowns on exchanges and DeFi platforms.

- Liquidity crises may occur if ETF demand stagnates.

- Geopolitical tensions are affecting crypto markets.

Additionally, the SEC’s hesitation to approve Ethereum ETFs raises questions about whether other cryptocurrencies will gain similar mainstream traction.

The Future of Crypto Regulation: Key Debates

As the crypto industry matures, several regulatory challenges remain unresolved:

1. Securities vs. Commodities Debate

The SEC’s stance that most altcoins are securities (subject to strict investor protections) clashes with the crypto community’s push for decentralized, commodity-like treatment. Courts may ultimately decide how tokens are classified.

2. Stablecoin Oversight

The collapse of TerraUSD (UST) in 2022 highlighted risks in stablecoins. Regulators are now pushing for reserve audits, transparency rules, and issuer licensing to prevent future meltdowns.

3. DeFi and Smart Contract Regulation

Decentralized finance platforms operate without intermediaries, posing a challenge for traditional regulators. Policymakers are exploring how to apply AML and KYC (Know Your Customer) rules to DeFi without stifling innovation.