Sustainability—More Than Just a Trend

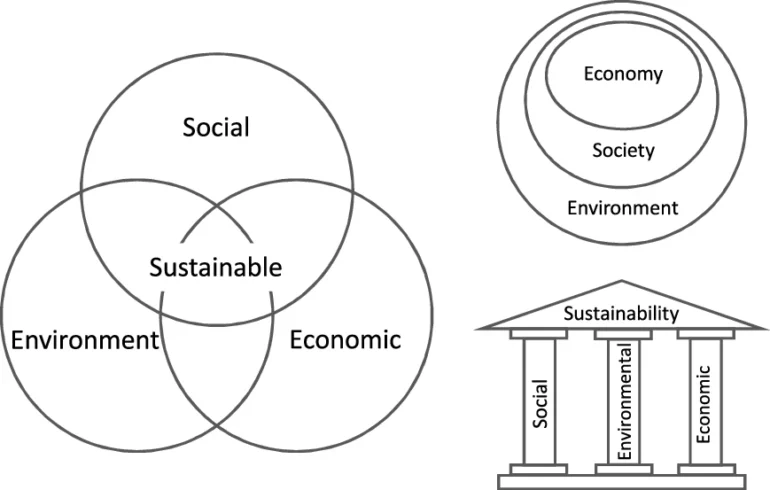

This is one of the words most uttered in the past several years, but it is a trend that will never leave. Green business and eco-friendliness were among the buzzwords introduced to the mainstream business lexicon. For many companies, sustainability slides into place as a branding tool or corporate buzzword rather than a real priority. Is sustainability going to impact profitability? This question has been haunting executives and stakeholders alike for years. Hard numbers—not ideals—are increasingly becoming the answer.

A Change in the Yardsticks: ESG Performance as a Financial Yardstick

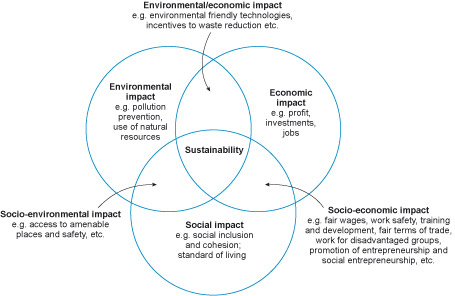

ESG metrics have ceased to be mere ethical appraisal—they have evolved into essential components for assessing financial strength and sustainability of success. In several studies conducted by financial institutions such as Morgan Stanley, Harvard Business School, etc., it has been established that firms with strong ESG performance usually outperform their counterparts in the longer term.

Why? Because companies aligned with ESG are usually more risk-oriented, better at resource optimization, and their consumers and investors trust them more. Fundamentally, in our view, good sustainability practices translate into good business management.

Saving energy means cutting down on costs.

A clear way that sustainability improves the bottom line is through energy efficiency. Companies that invest in renewable energy, LED lighting, smart HVAC systems, and energy audits often see immediate reductions in their operational costs.

For example, a 2023 report by McKinsey outlined that companies with aggressive energy-efficiency programs reduced their overhead up to 25% annually. It’s that simple: when energy costs go down, profit margins go up.

Waste Reduction & Circular Economy: Savings via Innovation

Another big money benefit of being green comes from cutting waste & circular business models. Firms that discover how to reuse stuff, shrink packaging, or go biodegradable not only lessen their eco-footprint but also trim supply chain & production costs.

Brands like IKEA and Dell, which have embraced the circular principle, report not just environmental improvements but substantial logistical savings plus increased consumer trust due to transparent practices.

Consumer Behavior and Revenue Growth

Data always shows that the preference of consumers is changing towards sustainable brands. More than 73% of global consumers told us that they would change their buying habits to reduce environmental impact- 2024 Nielsen Report. More importantly, 48% of them are willing to pay a premium for sustainable products.

This, in turn, creates revenue opportunities. Companies that provide eco-friendly products, ethical sourcing, and environmentally aware packaging are winning new market segments with much higher average order values.

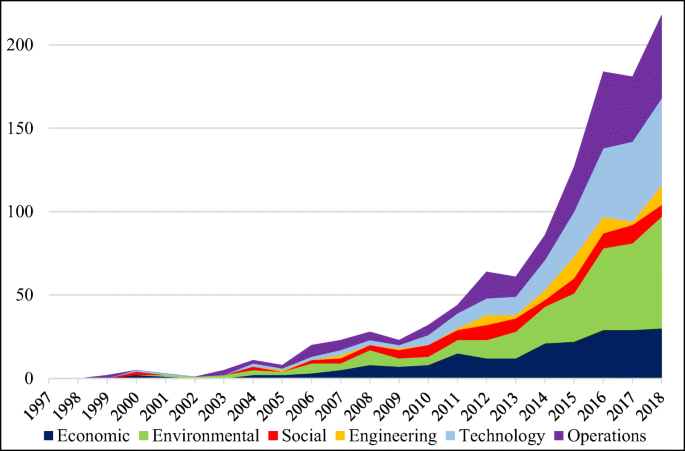

Investment and Capital Access: A Green Premium

Sustainability not only pulls consumers. It pulls capital, too. More and more investors are investing their money in ESG-focused companies. In the year 2023, global sustainable investment went beyond $40 trillion, and firms complying with ESG often enjoy lower borrowing costs, higher stock valuations, and easier access to institutional capital.

Companies with stated sustainability objectives and open ESG disclosures get much index inclusion, leading to long-term capital benefits and strength in downturns.

Workforce Recruitment and Retention: Cost Savings in Human Resources

Individuals want to work in organizations that value their beliefs. According to a report by LinkedIn Green Jobs 2024, it states that “employees are 67% more likely to stay at a company with strong sustainability values.” This implies lower turnover rates; therefore, the cost of hiring new employees is reduced as well. It also means an inspired and enhanced productivity among the workforce.

Workplaces oriented towards sustainability also rank higher in job satisfaction and employer branding, which lowers recruitment and training costs.

Risk and Reputation Management

Climate regulations or even a public relations disaster at a company for ignoring sustainability practices puts them on the pedestal of reputational and regulatory risks. This approach to proactive environmental strategy would ensure the following protection from:

- Fines and lawsuits

- Supply chain climate disruptions

- Boycotts or social media backlashes

Such companies tend to be more resilient and enjoy lower insurance premiums; this leadership advantage is most evident in agriculture, energy, and retail, where environmental impacts matter

The Business Case for Sustainability Is Proven

It has been settled—sustainability leads to profitability. From cost savings and customer loyalty to capital raising and employee retention, the hard data confirms that green practices are not just ethically laudable—they’re economically sound.

Companies that see sustainability as a strategic investment are ahead of those that perceive it as a short-term PR expense. The faster companies adopt responsible environmental and social practices, the stronger their bottom line will be—not just today, but for years into the future.